LONDON,

As the automobile gets increasingly mature, auto firms will rely largely on automotive electronic technology to enhance the performance of automobile. With the adoption of more and more safety assistant systems, automotive electronic systems will account for over 60% of car costs. Global automotive electronics market size grows by 11.9% to USD201.9 billion in 2015. As consumers pay more attention to safety and comfort of the car, the proportion of automotive electronic accessories will by degrees increase. It is predicted global automotive electronics market size will exceed USD300 billion in 2020.The report focuses on development status and trends of automotive electronics segments, covering eight fields: Airbag, TPMS, ADAS, IVI, Navigation & Audio, Automatic Transmission, Fuel Injection, Automotive Lighting, and Telematics.

Automotive safety system:

The global automotive safety system market size hit USD27 billion in 2015, up 4.1% from a year ago; and it is expected to grow 3.7% to USD28 billion in 2016. One reason for decelerated growth lies mainly in obvious deflation, and the falling prices of industrial raw materials also caused a drop in the prices of finished products; the other reason is that China as the world's largest auto market sees sharp slide, bound to be flat in 2015. The situation is expected to turn better by 2017 when global automotive safety system market is worth USD29.4 billion, an increase of 5.1%.

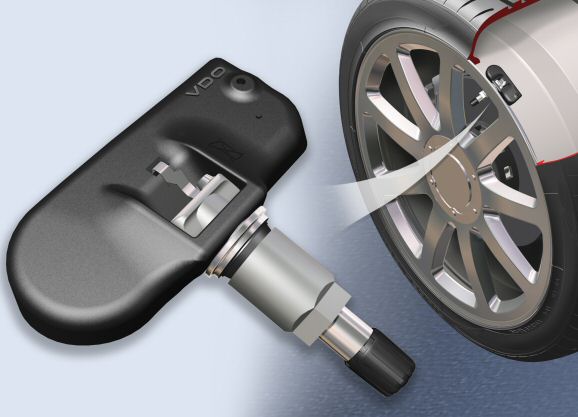

TPMS:

Global installation rate of TPMS reached 36% in 2014, up 6 percentage points from 2013, and is expected to exceed 45% in 2015, creating a demand of more than 40 million sets.EU (European Union) now is the focus of global TPMS. On the one hand, its OEM demand for TPMS is expected to hit 16.65 million sets, surpassing the United States as the world's largest market, and on the other hand, considerable AM demand for TPMS is brought about. Harsh winter in many EU countries makes snow tire an additional necessity for new vehicles. Hence, the introduction of mandatory regulations on TPMS in November first created demand for TPMS from snow tire.

EU will become the world's largest TPMS market, either in OEM or AM.The mainland China compiled its first technical standard for passenger vehicle TPMS in Mar 2015, and carried out a month-long opinion soliciting. Its demand for TPMS comes primarily from OEM market and has grown rapidly during 2014-2015.The demand surged by 78.9% from a year ago to 4.42 million sets in 2014 and is expected to reach 6.67 million sets in 2015, a year-on-year jump of 50.9%. Relying on huge automobile market, China has become the TPMS market with the greatest potential, attracting a large number of companies

ADAS:

It has been one of the fastest-growing sectors in automotive field and is expected to register a CAGR of 32% during 2014-2019. Currently, developed countries in Europe and America have had nearly 8% of new vehicles equipped with ADAS, in contrast to about 2% in emerging markets. It is predicted that over 25% of new vehicles will carry ADAS by 2019 globally.In passenger vehicle field, ADAS integrators are large in number, mostly being large auto parts companies. At present, the leading companies are technologically developing toward combination and integration of active safety with passive safety and integration of multiple ADASs.

Globally, Continental AG boasts the largest market share, as well as No. 1 as concerns researchers and capital investment in ADAS and automated driving technology. Compared with passenger vehicles, the system integrators that are supplying ADAS for commercial vehicles are highly concentrated, with WABCO, Continental AG and Bosch eyeing 60% global market share.China's ADAS industry is also in rapid development over the years.

Some companies backed by colleges, universities and other research institutions have the research and development ability of core algorithm and have received market recognition. At the same time, some traditional auto parts manufacturers represented by INVO Automotive Electronics, Jinzhou Jinheng Automotive Safety System and HiRain Technologies are flooding into the ADAS market and have realized OEM installation by virtue of resources from the original vehicle manufacturers.

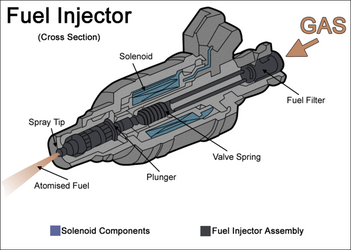

Fuel injection:

With the implementation of the national IV emission standard, as the most suitable technology roadmap, common rail system for diesel engines witnessed rapid development. In May and June 2014, the mainstream Chinese heavy and light-duty truck manufacturers signed letters of commitment, vowing not to sell models that fail to meet emission standards, which, to a great extent, helped improve assembly rate of high pressure common rail system.

With excellent performance in energy conservation and emission reduction, diesel-powered models have been widely recognized in the global automobile market. Made in China 2025, released by China in May 2015, said that the Government will press ahead with the application of diesel engines in passenger vehicles. At present, some automakers have kicked off diesel vehicle project. In the future, with the development of diesel-powered passenger vehicles, the proportion of high pressure common rail system equipped in passenger vehicles is expected to rise.

Telematics:

AS Chinese passenger vehicle manufacturers accelerate to popularize telematics system in 2015, smartphone integration and 4G LTE technologies have found wider application, and IVI (In-Vehicle Infotainment) and networking functions have got enriched and optimized to get better user experience.In January-September 2015, China's new passenger vehicles equipped with telematics products approximated 1.8 million units, up 32.1% from a year earlier. Among them, OnStar held 26% and ranked first, followed by SYNC and Honda Link.

It is noted that in 2015 Changan Automobile launched several models equipped with In Call system, occupying 7%, thus making it the only self-owned brand that ranked among the top 5.It is projected that prior to 2016 the penetration of OEM telematics will be on the rise. On the one hand, the model of OEM-led platform and third-party telematics enterprises providing services will continue to be adopted. They will work together to deliver more of more mature products and services to car owners. On the other hand, passenger vehicle market is unlikely to recover and grow like the previous high-speed expansion, which would entail prompting OEMs to rapidly lift OEM telematics pre-installations to compete for the market.?

Global and China Automotive Electronics Industry Chain Report, 2015-2018 highlights the followings:

Overview of the Chinese auto market and parts market (output & sales volume of passenger vehicle and commercial vehicle, competitive landscape of passenger vehicle, commercial vehicle, and parts);Overview of global and Chinese automotive electronics market (definition & classification, market size, development history, development trends);Airbag, TPMS, ADAS, IVI, Navigation & Audio, Automatic Transmission, Fuel Injection, Automotive Lighting, and Telematics (definition & classification, development course, industrial standards, policies & regulations, R&D route, market size, output & sales volume, supporting, market demand, competitive landscape, import & export, development trends);Major global and Chinese parts companies, including Continental, Denso, Bosch, Delphi, Autoliv, ZF TRW, Magneti Marelli, Aisin Seiki, Mobis, Valeo, Schrader, and WABCO (profile, business in China, financial situation, output & sales volume, major customers, main products, supporting, production bases, technical roadmap, business development in automotive electronics segments).