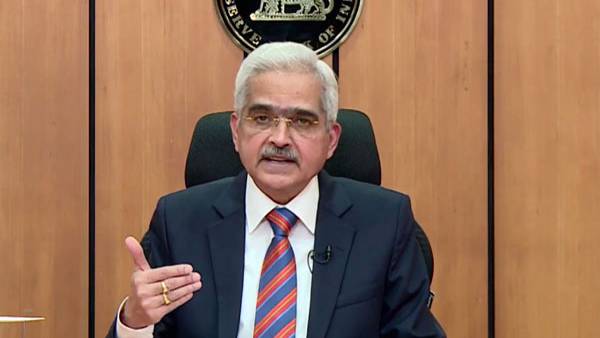

The Federal Reserve has begun raising interest rates to control inflation, which has begun to weigh on the international economy today. In this context, the RBI raised interest rates for the second time today at a meeting of the Central Bank. Not only this, but it has also given many more announcements. Especially for the benefit of UPI users, it has also allowed credit cards to be linked to the UPI platform so that UPI users can make payments from Rupay credit cards through UPI. This was stated by governor Shakti Kanta Das at a meeting of the Reserve bank today.

The UPI service, which is one of the most popular money transfer systems in india today, is now allowed to connect to the credit card as well. There are currently over 26 crore individual users and 5 crore merchants in India. In May 2022 alone, Rs 594.63 crore worth of transactions are done.

The UPI service, which is one of the most popular money transfer systems in india today, is now allowed to connect to the credit card as well. There are currently over 26 crore individual users and 5 crore merchants in India. In May 2022 alone, Rs 594.63 crore worth of transactions are done. These UPI services allow you to easily transfer money (via debit card) by linking your current account with your savings account. As such, credit card transactions are currently allowed. The first step is to make a transaction with a Rupay credit card. This can be useful for customers to easily transact.

These UPI services allow you to easily transfer money (via debit card) by linking your current account with your savings account. As such, credit card transactions are currently allowed. The first step is to make a transaction with a Rupay credit card. This can be useful for customers to easily transact. It has been announced that this service will be available after completing the required procedures. With this announcement by RBI, by linking one's credit card and debit card with UPI, they can scan the QR code and pay without having to swipe the card. OTP will come to your registered mobile number. So it is safe.

It has been announced that this service will be available after completing the required procedures. With this announcement by RBI, by linking one's credit card and debit card with UPI, they can scan the QR code and pay without having to swipe the card. OTP will come to your registered mobile number. So it is safe. You must have a credit card or debit card linked to UPI. According to google pay, an individual can add Axis bank, sbi Cards, Kodak bank, hdfc bank, Indus bank, Federal bank, RPL bank, HSBC bank, ICICI bank, and OneCard. These must operate on Visa and Gateways.

You must have a credit card or debit card linked to UPI. According to google pay, an individual can add Axis bank, sbi Cards, Kodak bank, hdfc bank, Indus bank, Federal bank, RPL bank, HSBC bank, ICICI bank, and OneCard. These must operate on Visa and Gateways. How to connect to google Pay?

How to connect to google Pay?Step 4: After registering all this you have to accept the terms and conditions. You can then use it in stores and wherever you need it.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel