Until 2016, investing in the stock market was a club for the suited few — brokers yelling in Dalal Street pits, old men reading pink newspapers, and the occasional harshad Mehta-wannabe shouting “BUY!” like it was a war cry. Then came mukesh Ambani, with a masterstroke that didn’t just change telecom — it rewired India’s financial DNA. He gave the internet away. And with that, every indian holding a smartphone got a front-row seat to Dalal Street.

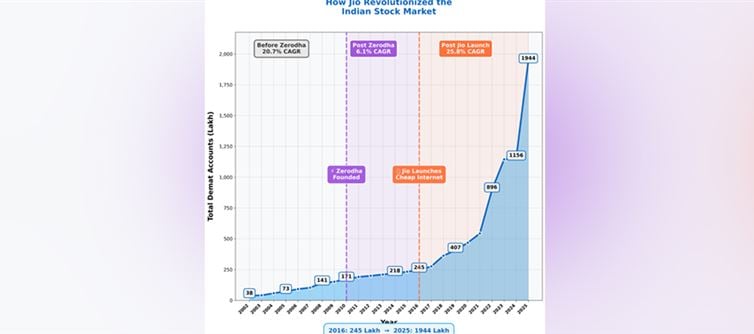

Today, india has 20 crore Demat accounts, up from just 2.4 crore in 2016 — a mind-blowing 8x jump in nine years. This isn’t a bull run. This is a wallet PLATFORM' target='_blank' title='digital-Latest Updates, Photos, Videos are a click away, CLICK NOW'>digital awakening.

📈 1. BEFORE JIO: THE STOCK MARKET WAS A RICH MAN’S CLUB

Before Jio’s revolution, stock investing was wrapped in mystery and gatekeeping. You needed a broker, a form, a signature, a relationship manager — and a lot of patience. For most Indians, “the market” was something on tv — a scrolling ticker with alien symbols. people thought only men in suspenders at the BSE shouting in chorus could make money there. The rest of us just watched.

Trading was a physical act. Investing was a generational privilege. And financial literacy? A myth.

📶 2. POST JIO: AMBANI TURNED EVERY SMARTPHONE INTO A STOCK TERMINAL

When jio dropped free internet like a wallet PLATFORM' target='_blank' title='digital-Latest Updates, Photos, Videos are a click away, CLICK NOW'>digital bomb, the gates to the financial world blew wide open. Suddenly, the same phones that were used for whatsapp forwards and cricket memes became tools of financial empowerment. You didn’t need a broker — you just needed an app.

Platforms like Zerodha, Groww, and Upstox rode the jio wave, simplifying trading for the masses. With cheap data, YouTube tutorials replaced stock advisors. Telegram groups replaced brokerage tips. And one tap replaced a hundred forms.

From chai stalls to college canteens — everyone became a “market expert.”

💰 3. THE NUMBERS THAT TELL THE STORY

2016: 2.4 crore Demat accounts.

2025: 20 crore Demat accounts.

Growth: 2 crore new investors every single year since jio launched.

That’s not growth — that’s a cultural mutation.

The share market became a national pastime. IPO listings trended on X. YouTube channels with cartoon charts hit a million views. college students started tracking Nifty instead of Netflix.

Ambani didn’t just sell SIM cards — he sold financial access.

🧠 4. FROM “HARSHAD WHO?” TO “HARSHAD HOW?”

Pre-Jio, harshad mehta was a name whispered in financial folklore — a man who broke the system and became a legend.

Post-Jio, every young trader with a Zerodha app, Wi-Fi, and a dream thinks they can do the same — minus the scams, hopefully.

They’ve realized you don’t need to stand in front of the BSE to move money — you just need a 4G connection and a bull run.

⚖️ 5. INDIA’S STOCK MARKET REVOLUTION ISN’T PERFECT — BUT IT’S OURS

Yes, the Jio-driven retail investor boom has its dark side — overconfidence, meme trading, market manipulation, and loss-chasing. But for the first time in history, the stock market belongs to everyone. The internet didn’t just democratize entertainment — it democratized capitalism.

And that’s something no brokerage policy or SEBI reform could ever achieve.

Ambani didn’t build a telecom empire — he built India’s investor class.

💥 BOTTOM LINE

What harshad mehta did with charisma and chaos, jio did with connectivity and code. In just nine years, Ambani turned india from a nation of savers into a nation of investors — and maybe gamblers too.

Whether it’s a revolution or an illusion depends on the next market crash.

But one thing’s for sure — the bull run started with a SIM card.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel