India's retail inflation (CPI) in october was at a three-month low of 6.7 percent and wholesale inflation (WPI) at a 19-month low of 8.39 percent. The bigger question is how the global economy will fare in November. With the monetary policy meeting to be held in december, the RBI decision is very important for the middle class and monthly salary earners. With the RBI's interest rate hike, interest rates for all loans, including home loans, personal loans, and gold jewelry loans will increase. Such an increase in interest rates will affect the middle class and monthly salary earners more.

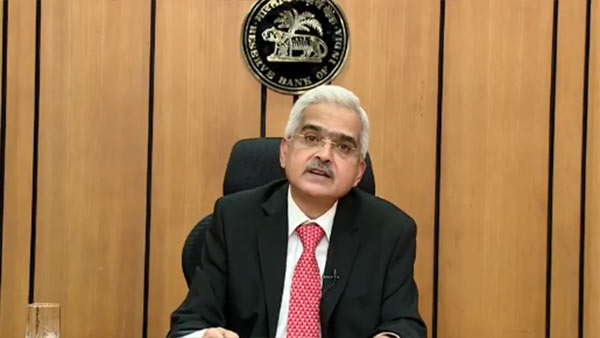

RBI hiked its benchmark interest rate, the repo rate, by 50 basis points in the last monetary policy meeting chaired by reserve bank of india Governor Shaktikanta Das on september 30. The RBI has hiked interest rates around 4 times since May 2022 to curb inflation. With this, the repo rate has already increased by 1.9 percent, taking its repo rate to 5.9 percent, the highest in 3 years.

RBI hiked its benchmark interest rate, the repo rate, by 50 basis points in the last monetary policy meeting chaired by reserve bank of india Governor Shaktikanta Das on september 30. The RBI has hiked interest rates around 4 times since May 2022 to curb inflation. With this, the repo rate has already increased by 1.9 percent, taking its repo rate to 5.9 percent, the highest in 3 years. It is in this situation that the RBI is going to hold its monetary policy meeting on december 5-7. The decision to be taken by RBI in this meeting is very important, as Britain, France, and germany are already stuck in recession, and this decision will be important. In India, inflation still has not been brought below the RBI's target level of 6 percent, and the monetary policy needs to be controlled. India's inflation has remained above the RBI target for the past 10 months.

It is in this situation that the RBI is going to hold its monetary policy meeting on december 5-7. The decision to be taken by RBI in this meeting is very important, as Britain, France, and germany are already stuck in recession, and this decision will be important. In India, inflation still has not been brought below the RBI's target level of 6 percent, and the monetary policy needs to be controlled. India's inflation has remained above the RBI target for the past 10 months. With 190 basis points of interest rate hikes in 4 steps since May, recession fears are high around the world and the december meeting is bound to see an interest rate hike. Otherwise, the repo rate will be hiked at a meeting in early 2023. S&P Global Ratings predicts India's inflation to average 6.8 percent in the current fiscal year and RBI's benchmark interest rate to rise to 6.25 percent by march 2023.

With 190 basis points of interest rate hikes in 4 steps since May, recession fears are high around the world and the december meeting is bound to see an interest rate hike. Otherwise, the repo rate will be hiked at a meeting in early 2023. S&P Global Ratings predicts India's inflation to average 6.8 percent in the current fiscal year and RBI's benchmark interest rate to rise to 6.25 percent by march 2023. This has increased expectations.Meanwhile, the RBI is doubtful to raise interest rates in december with the meeting a few days ago suggesting that the US has slowed its pace of rate hikes, but is bound to do so once before the 2022-23 financial year.

This has increased expectations.Meanwhile, the RBI is doubtful to raise interest rates in december with the meeting a few days ago suggesting that the US has slowed its pace of rate hikes, but is bound to do so once before the 2022-23 financial year.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel