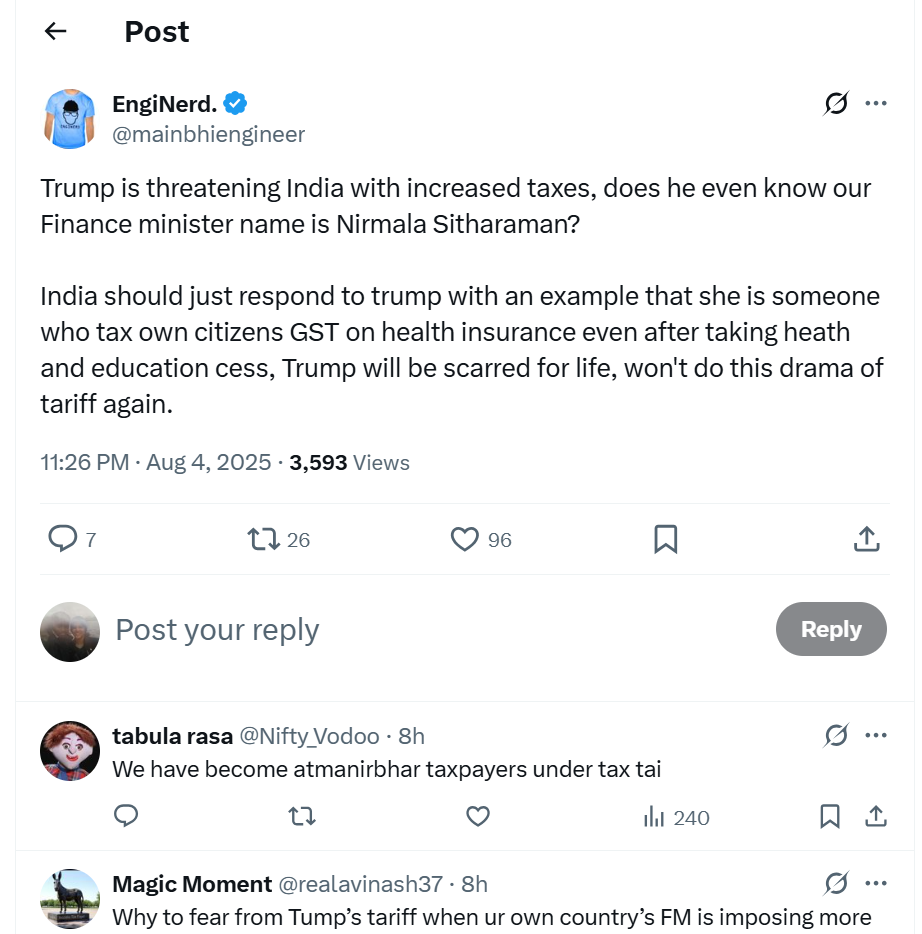

In a sharply worded counter, many indians suggest that Trump’s tariff threats pale in comparison to what their own government levies on them. Citizens sarcastically point out that india taxes essential services like health insurance under GST, despite already collecting a health and education cess.

This has become a defining example of the over-taxation many indians feel burdened by. The irony isn't lost on netizens, who say if trump truly understood the extent of India’s internal taxation policies, he’d realize that his tariff threats would be considered minor in comparison. As one viral post put it: "Dear trump, our Finance minister taxes our medicines and hospital stays. Do your worst."

This has become a defining example of the over-taxation many indians feel burdened by. The irony isn't lost on netizens, who say if trump truly understood the extent of India’s internal taxation policies, he’d realize that his tariff threats would be considered minor in comparison. As one viral post put it: "Dear trump, our Finance minister taxes our medicines and hospital stays. Do your worst."This backlash reveals a growing frustration among indian taxpayers about the structure and layering of taxes in the country. While the government maintains that GST has streamlined the taxation process, many argue it has complicated and inflated costs for average citizens. Trump's remarks have unintentionally rekindled this domestic debate, making indians reflect not only on global trade dynamics but also on their own government's fiscal policies. If anything, this episode has become a moment of humorous unity for indian netizens, who are turning their frustrations into satire, reminding Trump—and perhaps even Sitharaman herself—of just how heavily taxed india really is.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel