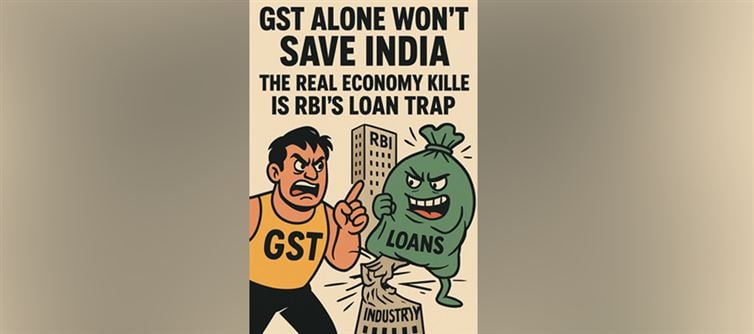

Everyone’s busy clapping for GST, as if it’s the single-handed savior of India’s economy. But let’s get real—GST helps the common man, not the backbone of the economy. If industries don’t breathe, the nation doesn’t grow. And right now, industries—big and small—are suffocating under the iron grip of sky-high loan rates.

What india needs is not just tax reform but credit reform. A simple 0.5% cut in loan rates could unleash a tsunami of growth, jobs, and innovation. But RBI’s rigid stance has turned India’s industrial dream into a slow-motion nightmare.

Let’s break it down, brutally.

1. GST is a Band-Aid, Not Surgery

Sure, GST simplified taxes. It benefits traders, shopkeepers, and consumers.

But industries? They’re drowning in debt. GST doesn’t heal their wounds—it just gives them a clean invoice.

2. industries Are the Economy’s Heartbeat, Not Retail Shops

Factories create jobs. Factories drive exports. Factories build infrastructure.

Yet, they’re being bled dry by loans that cost them their very existence.

3. RBI’s iron Grip Is Strangling Growth

A 0.5% cut in rates sounds small, right? But for industries borrowing thousands of crores, that’s crores saved—money that can go back into jobs, plants, and R&D.

Instead, RBI’s obsession with inflation is killing future growth before it even starts.

4. GST Won’t Make You Globally Competitive – Cheaper Credit Will

Competing with China, Vietnam, or even bangladesh isn’t about GST rates.

It’s about cost of credit, cost of capital, and how much it takes to build, run, and expand industries.

Right now, india is playing with shackles on.

5. The Silent Exodus of Entrepreneurs

Ask small and medium industries—they’re shutting shop or moving abroad.

Why? Not because of GST. Because loans here are a death trap.

6. RBI Needs a Reality Check, Not a Balance Sheet Check

Inflation isn’t the only enemy. Unemployment, slow growth, and industrial stagnation are far deadlier.

RBI must wake up before the "Make in India" dream turns into "Shut Down in India."

🔥 Bottom Line: GST is overrated hype. The real war is not about taxes but about loans. If india wants to be an economic superpower, it needs to slash interest rates for industries, unleash cheap credit, and fuel the fire of growth.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel