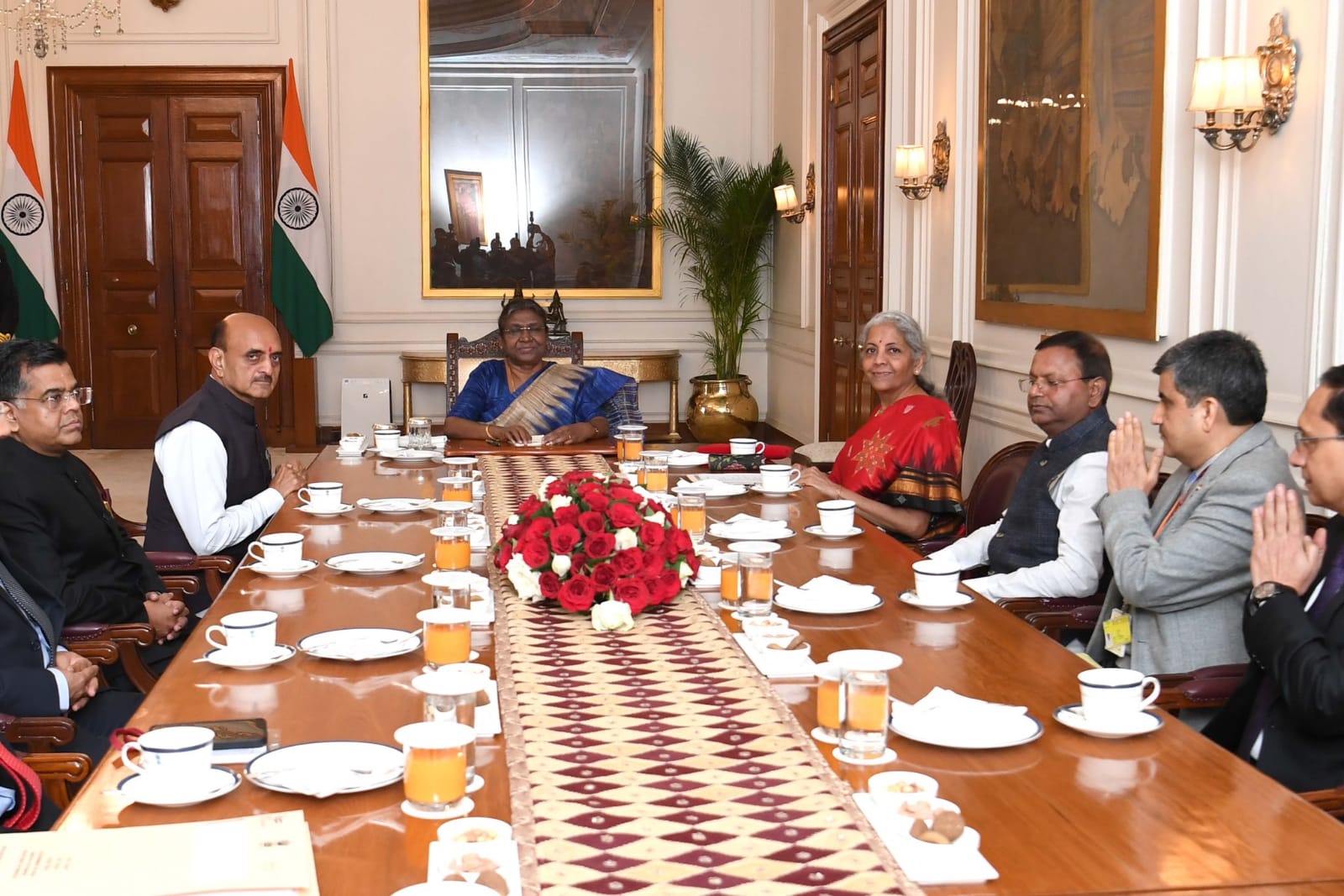

An issue related to the budget concession announced by Union minister Nirmala Sitharaman was mentioned recently. In addition to the existing personal income tax exemption of Rs.5 lakh, an offer has been announced to increase it to Rs.7 lakhs.

When this new policy goes into the depths, it is heard that even if there is a small difference, if this new policy is chosen, it will break the bank.Initially, it said there was a positive expression of this offer. As the day passed by, they said that there was no other danger beyond this new tax system. It is said with an example.

Nirmala stated that there is no income tax on Rs.7 lakhs, which would be beneficial for middle class people who get an annual income of Rs.7 lakhs. However,if the income is more than one rupee per Rs.7 lakh, the benefit under this new system will not apply. If that happens, then they will have to pay tax up to Rs.25 thousand for even one rupee of additional income.

Many people say that considering their gross salary, which is less than seven lakhs, there is a risk if they choose this option in haste. In addition to the salary,but in the middle of the year, at the end or in the form of a bonus. If any other incentives come,there is a risk that they will exceed Rs. 7 lakhs.

It is said that even if there is any mistake in that matter, there will be a huge tax burden. So, even if it seems good to take a new approach, it is said that one should carefully check once or twice, otherwise there will be a huge flood. So, many people are saying to be careful.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel