It is learned that the deadline for linking the PAN number with the Aadhaar number has been extended from march 31, 2022, to march 31, 2023. However, the fee for linking the Aadhaar-PAN number has to be paid from april 1, 2022. The Central Board of Direct Taxes (CBDT) issued a press release on march 29 this year.

Aadhar - PAN Link:

Aadhar - PAN Link:If you link your PAN number with aadhar on or before june 30, 2022, you will be charged Rs. 500. If Pan-Aadhar is linked on or after July 1, it will double to Rs. 1,000 to be paid. According to a statement issued on march 29 this year, the taxpayers have been given till march 31, 2023, to link their aadhar PAN numbers. However, taxpayers will have to pay Rs. 500 and after that Rs 1000.

It has also been announced that the action will be applicable to activities under the Act such as PAN, Withdrawal of Income, and Withdrawals of Assessors who have not disclosed their evidence till march 31, 2023, next year. Therefore, those who have not yet linked their Aadhar-PAN numbers are advised to pay Rs.500 immediately and join. Now let's see how to combine Aadhaar-PAN numbers.

It has also been announced that the action will be applicable to activities under the Act such as PAN, Withdrawal of Income, and Withdrawals of Assessors who have not disclosed their evidence till march 31, 2023, next year. Therefore, those who have not yet linked their Aadhar-PAN numbers are advised to pay Rs.500 immediately and join. Now let's see how to combine Aadhaar-PAN numbers. How to connect via SMS?

How to connect via SMS?You can also connect your 12-digit reference number and 10-digit PAN by sending an SMS to 567678 or 56161 on your mobile. Once aadhar - PAN is connected, you will be confirmed via SMS.

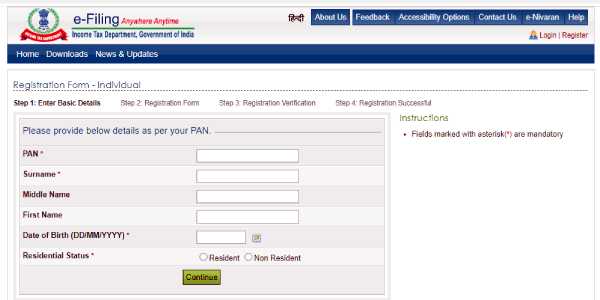

How to connect online?

How to connect online? Go to the Income Tax e-filing website and register there. After completing the OTP verification, you will need to enter the PAN card details, create a password, and log in again. If you have probably already registered, click Login. Go to the official website of the Income Tax Department and click on the link to link the reference number. Now type in your PAN number and aadhar number. From the Drop-Down menu, click on the Aadar option. Now your two documents will be merged. A message will be sent to confirm the connection.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel