HDFC - Loan borrowers will see a rise in the EMIs?...

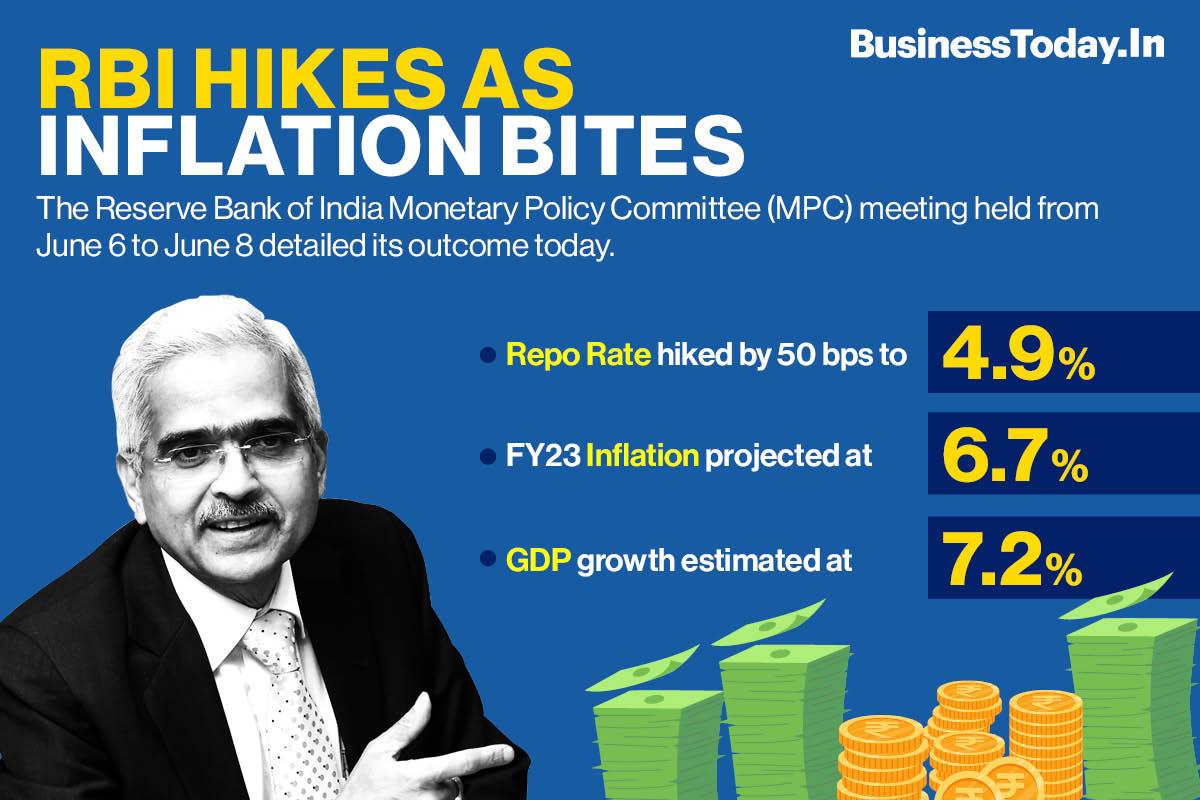

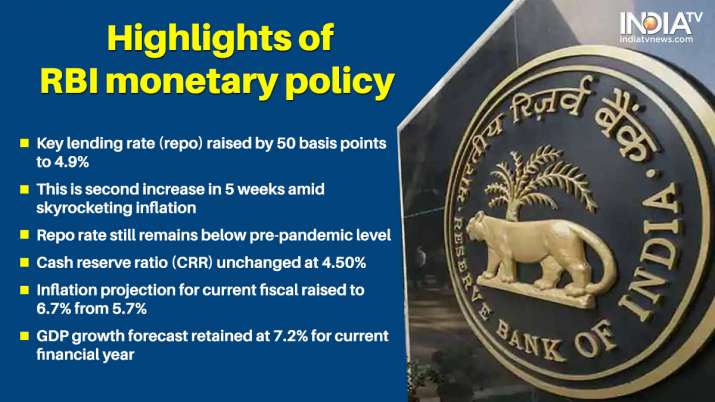

A day after the bank OF INDIA' target='_blank' title='reserve bank of india-Latest Updates, Photos, Videos are a click away, CLICK NOW'>reserve bank of india hiked the repo rate by 50 basis points to check the fast-rising inflation, HDFC, ICICI, bank of Baroda, RBL and many home loan lenders including Federal bank have increased their home loan interest.

HDFC, one of the country's largest lenders, on thursday said its lowest home loan will now start at 7.55% up from 6.7% in March. ICICI loan rates will now start at 8.6%, while that of RBL will start at 8.55%. The EMI of the existing floating home loan will also increase. Let us know how you can keep your EMI low?

Option to transfer loan:

There are many options available for those who want to keep their EMI low. A customer can easily refinance his loan. Many lenders offer lower rates than the rates they get from their existing lender. Almost all the lenders provide this service. However, refinancing works on loan transfers only if the borrower still has a substantial amount of loan to be repaid.

Short term loan

Most of the banks give loans up to 30 years. The most popular tenure that borrowers opt for loan repayment is 20 years. However, if one wishes to reduce the EMI, one can extend the tenure of the loan. The downside of availing this is that he has to pay a higher interest amount. However, it also means freeing yourself from the burden of the loan by making a one-time prepayment. If you can increase the amount to pay more EMI by increasing the amount a little more, then your loan will end soon.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel