Whenever U.S. elections loom, indian IT stocks inevitably get dragged into tariff speculation. The latest “breaking” headline from Reuters warning that donald trump could slap tariffs on indian IT giants—TCS, Infosys, Wipro, HCL—sent jitters across Dalal Street during market hours. But the question remains: is this a genuine policy signal, or just well-timed fearmongering?

The reality is, trump thrives on tariff rhetoric. His past actions showed a preference for headline-grabbing threats, often used as negotiating leverage, rather than long-term policy blueprints. indian IT exports to the U.S. are overwhelmingly service-driven, not goods-based. Tariffs, in the strict sense, apply to imports of physical products. To translate that into the services sector would require a complex legislative and regulatory retooling—not something that can be rolled out overnight.

Moreover, the U.S. corporate ecosystem, from Wall Street banks to Silicon Valley giants, is deeply dependent on indian IT support. Slapping tariffs or “service duties” would not only raise costs for American businesses but also trigger a legal and diplomatic storm under WTO frameworks.

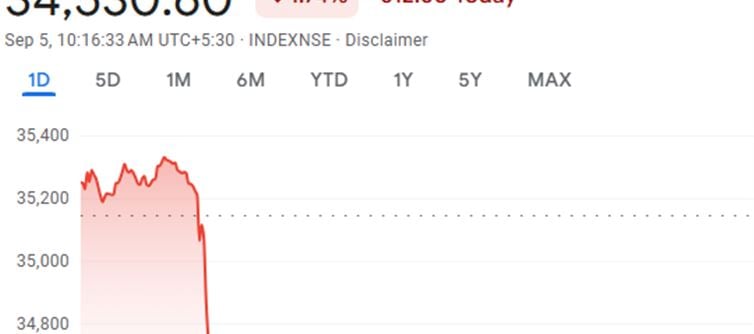

So why the noise? Timing is everything. A strategically dropped headline during market hours achieves exactly what it intends: rattled traders, spooked retail investors, and quick price volatility. In an election cycle defined by uncertainty, Reuters may well be serving up anxiety as news.

Instead of panicking at every tariff drumbeat, investors should remember this: indian IT’s strength lies in its indispensability. The U.S. cannot run its wallet PLATFORM' target='_blank' title='digital-Latest Updates, Photos, Videos are a click away, CLICK NOW'>digital backbone without India’s coding, testing, and maintenance powerhouses. If tariffs ever move beyond talk, the bigger blow may be to American boardrooms, not Bengaluru.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel