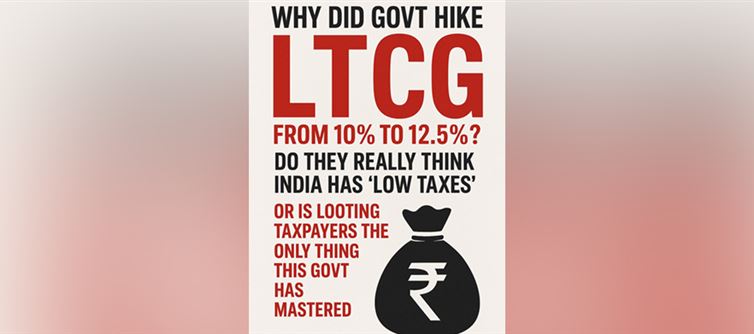

The government has decided to hike Long-Term capital Gains (LTCG) tax from 10% to 12.5%, claiming india still has “low taxes.” But the reality is very different—this move feels less like reform and more like looting. Here’s why:

1. Punishing the Investor Class

Instead of encouraging savings and investments, the government is telling investors: thank you for taking risks, now pay us more.

2. Already High Tax Burden

From GST to fuel excise, to road tolls and income tax—Indians are already overtaxed. Adding higher LTCG is like squeezing the last drop out of citizens.

3. “Low Taxes” Myth

The claim that india has low taxes compared to the world is laughable. indians pay European-level taxes but get sub-Saharan infrastructure in return.

4. Looting Disguised as Reform

Every budget talks of “ease of doing business” and “investment-friendly policies,” but actions prove otherwise. The only ease seems to be in extracting money from taxpayers.

5. Broken Priorities

Instead of widening the tax net, fixing black money, or cutting wasteful spending, the government keeps targeting the same honest middle-class and investors.

👉 The message is clear: In india, if you work hard, save money, and invest wisely, you’ll be punished. If you expect better returns, you’re dreaming.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel