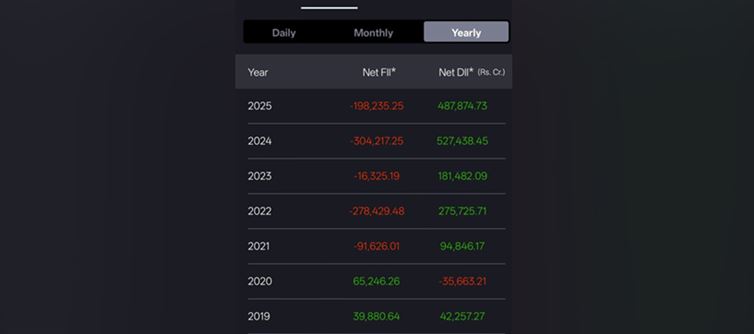

Chest-thumping slogans don’t fool Foreign Institutional Investors (FIIs). They follow money, policy, and vision—and india is failing on all three fronts. Numbers don’t lie: year after year, FIIs are pulling out, and here’s why 👇

1. Freebies Over Future 🚮

Instead of long-term investments in R&D, innovation, and infrastructure, the government keeps throwing taxpayer money into freebies and vote-bank Yojanas. Investors know this is not development—it’s political bribery.

2. Innovation Deficit = Investor Flight 💡➡️✈️

A country without robust R&D is a weak bet. FIIs don’t see cutting-edge labs, futuristic tech, or bold innovation policies—they see stagnation. Why risk capital in a place with no scientific backbone?

3. Looting Through Freebie politics 💰

Let’s call it what it is: freebies are just pipelines of corruption. Enter almost any neta or babu’s house and you’ll find crores of illegal wealth stacked away, while honest taxpayers and investors bleed.

4. Tax Squeeze, zero Accountability 🧾

india squeezes investors and citizens with higher taxes and fines, while giving a free ride to the corrupt. FIIs don’t invest where the government prioritizes looting over reform.

5. The Hollow ‘VishwaGuru’ Brand 🌍

No amount of PR can fool global investors. FIIs understand that a country shouting “VishwaGuru” while failing at innovation, governance, and accountability is not a safe bet.

👉 The Reality Check:

Unless india ditches its obsession with freebies and builds a real innovation ecosystem, FIIs will keep fleeing. And with them, India’s future growth story too.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel