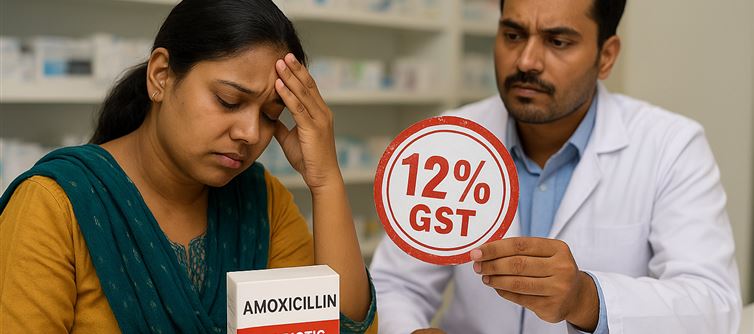

When GST Becomes a Death Sentence”

India’s tax system has found a new way to bleed its citizens—not at the fuel pump this time, but at the hospital counter. Amoxicillin and Azithromycin, life-saving antibiotics, attract 12% GST. Patanjali’s Churan? Just 5%.

This isn’t just bad economics. It’s criminal indifference.

For families already drowning in medical bills, that extra 12% isn’t “just tax.” It’s the skipped dose that worsens an infection. It’s the delay in buying medicine that turns a treatable illness into an ICU admission. In a country where health expenditure drives millions into poverty every year, slapping luxury-level tax on basic drugs is state-sponsored cruelty.

Meanwhile, Ayurvedic churnas—whose benefits are, at best, supplementary—get a pat on the back with a 5% GST. Why? Because it props up the political fantasy of “reviving heritage” while big corporates package it, market it, and mint gold. The wellness industry smiles, the pharma cartels lobby, and the common citizen coughs blood into a handkerchief.

Taxation is not neutral; it tells us what the State values. And right now, india is saying: your cough syrup is optional, but your Churan is sacred. The sick are paying for slogans.

This isn’t about promoting Ayurveda. It’s about punishing patients. If the government wants to support indigenous industries, do it. But don’t do it by taxing survival.

In any civilised society, health is a right—not a revenue stream. With this skewed GST, india has declared the opposite: that illness is a business model, and citizens are nothing more than paying customers in the market of misery.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel