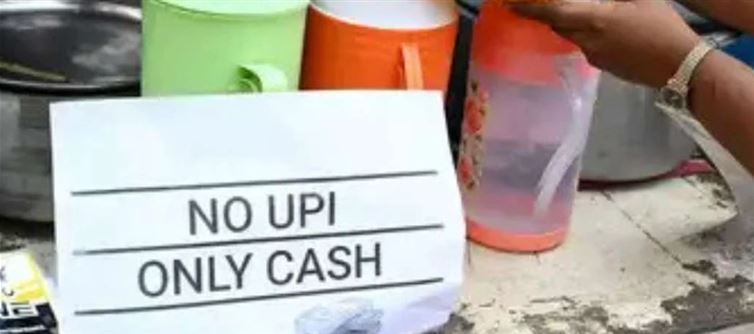

The impending tax issues and scrutiny are causing the merchants to worry. Vendors who previously thought that UPI and digital payments were convenient are now afraid that they may be harassed or forced to pay large taxes. Based on their UPI transaction data over the past few years, thousands of tiny, unregistered businesses have received Goods and services Tax (GST) letters, according to reports. According to the GST notices, they have exceeded the tax threshold but have neither registered or paid the GST.

What are the GST rules?

According to GST regulations, businesses that sell goods must register and pay taxes if their yearly revenue exceeds Rs 40 lakhs, while service businesses must pay taxes if their yearly turnover exceeds Rs 20 lakhs. According to tax officials, letters were only given to merchants whose UPI transaction data from 2021–2022 showed turnover above the predetermined threshold. According to the Department of Commercial Taxes, these companies must register, report their taxable turnover, and pay the relevant tax.

Many sellers, however, contend that it is incorrect to classify UPI transactions as income. Shankar, a Horamavu shopkeeper, reportedly stated, "I only make about ₹3,000 a day. To support my family, I make a little profit. I'm now afraid to use UPI for fear of getting into tax issues. S suresh Kumar, a bjp MLA, stated that he would write to chief minister Siddaramaiah over this issue.

Experts Opinion

"GST officers cannot rely solely on UPI credits to estimate turnover." Before making tax claims, they require concrete evidence, according to HD Arun Kumar, a former karnataka additional commissioner of commercial taxes. "Not all UPI payments represent revenue for businesses." Some might be loans, personal transfers, or family assistance, he continued.

Bengaluru might become a test case, according to Sreenivasan Ramakrishnan, a chartered accountant of Sreeni & Associates. Since every state is in dire need of money, other states would follow suit if the GST officials could collect a sizable amount of money by contacting unregistered sellers. Officials have focused on chat sellers in mumbai who have a lot of business. Given the enormous potential tax base, it's simply a matter of time."

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel