If 2025 has taught indian investors anything, it’s this: the market doesn’t care about fundamentals anymore. You can have record-breaking profits, expanding revenues, exploding EPS — and your stock will still behave like it committed a crime.

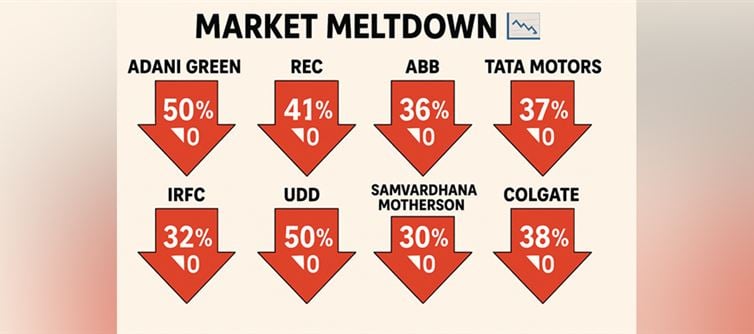

In the last year, more than 200 fundamentally strong companies have crashed anywhere between 30%–60%, creating the most bizarre disconnect between financial performance and stock performance india has ever witnessed.

This isn’t a correction.

It’s a massacre disguised as volatility.

THE GREAT DISCONNECT EXPLAINED

1️⃣ adani Green: +111% EPS, +26% Revenue… Stock Down 50%

A company doubling EPS year-on-year should skyrocket.

Instead, it nosedived.

Because sentiment said no.

Because narratives > numbers.

Because logic is on leave.

2️⃣ REC: Revenue Up 11% — Stock Down 41%

A government-backed financial giant with double-digit revenue growth gets punished like it defaulted.

Investors look at the numbers and scream:

“What more do you want from us?”

Market replies:

“Pain.”

3️⃣ ABB India: +13% Revenue… –36% Stock Price

A global engineering titan with a textbook balance sheet.

Strong order book.

Strong earnings.

Strong upside.

But the stock behaves like the company is selling papads instead of power equipment.

4️⃣ Samvardhana Motherson: EPS up 62% — Stock Down 30%

A company literally multiplying profits quarter over quarter — but punished like it filed for bankruptcy.

Q2 FY26:

EPS +62%

Revenue +18%

Market:

“Cool story, bro, go down.”

5️⃣ Tata Motors: Down 37% Despite Being… Tata Motors

It delivered strong EV numbers, leadership in SUVs, and global improvements —

But the stock fell harder than smallcaps.

Because when the market mood swings, even Tata isn’t spared.

6️⃣ IRFC: Railways Booming, Stock Falling 32%

The backbone of India’s railway financing.

Strong balance sheet.

Consistent profits.

But the stock chart looks like it rolled down a staircase.

7️⃣ UDD / UPL: Massive Revenue Growth, But 50% Crash

If the company really delivered +52% YoY revenue growth…

WHY is it down 50%?

Because one bad headline can erase a thousand good numbers.

8️⃣ Colgate – The Most Boring, Stable Company — Still Down 38%

Inflation-proof.

Recession-proof.

Toothpaste-proof.

Yet even Colgate couldn’t escape the market slaughter.

When FMCG starts bleeding, you know sentiment is not just weak — it’s humiliatingly depressed.

💥 BUT HERE'S THE TWIST: MANY HIDDEN GEMS ARE PERFORMING LIKE BEASTS

And nobody is watching them.

9️⃣ Godawari Power & Ispat — Low P/E, Strong Profits, High Efficiency

Revenue growth: steady

Profit: consistent

P/E: just 7

This is what “value stock” looks like — but retail runs behind hype, not fundamentals.

🔟 DB Corp — Print media Dinosaur? Nope. Profit Machine.

Revenue +9.9% YoY

Profit +13%

In a dying industry, this company refuses to die.

But the stock is ignored because it’s not “cool”.

1️⃣1️⃣ AGI Greenpac — Quiet Performer, Loud Numbers

Profit +5.6%

Strong ROCE

Expanding margins

This is the type of stock institutions quietly accumulate while retail is busy crying over trendlines.

🔥 THE REALITY CHECK — THE MARKET IS NOT BROKEN. SENTIMENT IS.

The 2025 market isn’t reacting to performance.

It’s reacting to:

Elections

Global recession fears

FII withdrawals

Bond yields

Liquidity crunch

Risk-averse sentiment

Overbought valuations from 2023–24

Panic selling

Even the best numbers can’t save you when the market mood is on life support.

🔥 FINAL TAKE

The indian market in 2025 isn’t rewarding good companies.

It’s punishing everyone equally — the best, the average, the hopeless.

This year has only one lesson:

“In the short term, fundamentals don’t control the market.

But in the long term, the market ALWAYS bows down to fundamentals.”

Until then?

Hold your breath.

Hold your conviction.

And hold your sanity.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel