Mutual Fund: 7 schemes of this fund gave bumper returns, 14 times more profit than the benchmark

The indian stock markets have seen huge volatility for some time now. During this period, the indian stock market bombay Stock Exchange (BSE) Sensex gave a return of only 1.41 percent.

Heavy withdrawal from the indian stock market by foreign investors, the tension created by russia and ukraine war, and the high inflation rate engulfed the stock markets all over the world. Due to this, huge volatility has been seen in the indian stock markets for some time now. During this period, the indian stock market bombay Stock Exchange (BSE) Sensex gave a return of only 1.41 percent.

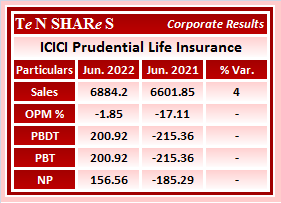

However, meanwhile, 7 schemes of ICICI Prudential Mutual Fund gave returns of up to 20 percent. That is, it has made investors up to 14 times more profit than the benchmark.

According to the data, ICICI Prudential schemes have given returns of 14 to 20 percent in a year. These include Bharat Consumption Fund, Equity & Debt, Multi-Asset, Retirement Pure Equity Fund, and FMCG Fund. Mutual fund experts believe that the strategy of this fund house is to prevent the scheme from giving low returns. For the past year, the fund house has followed a value strategy.

During this period, many of its schemes have given returns ranging from 7 to 13 percent. In this, Large & Mid-Cap, india Opportunities Fund, Dividend Yield Equity Fund, Value Discovery Fund, and MNC Fund have given higher returns than the category.

Fund house chief investment officer S. Naren says whatever our decision was, it has proved to be a good decision. We are overweight in power and energy. We invested in FMCG while reducing our investment in metals. We are still advising investors to invest in SIP and STP. We will consistently recommend investing in schemes that have different asset classes.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel