The core issue lies not in the lack of resources but in the mismanagement and systemic corruption that plague India’s infrastructure sector. Funds meant for road construction or maintenance are often siphoned off through inflated contracts, substandard materials, and political kickbacks. Although corruption has long been a chronic issue, many argue that the past 11 years under the BJP-led government have seen a worsening of accountability. Despite promises of “minimum government, maximum governance,” ground realities indicate that crony capitalism, opaque tenders, and political favoritism have only deepened. Contractors with political ties often win bids, leading to compromised quality and zero consequences.

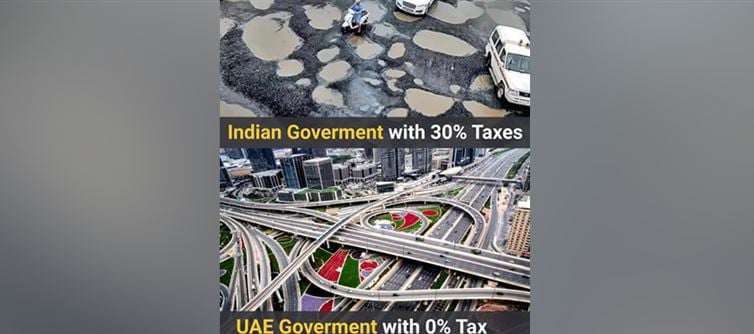

Citizens are increasingly disillusioned, especially when they compare India’s progress with nations that operate on transparent systems and deliver tangible results despite smaller budgets. The contrast between India’s tax-to-service ratio and countries like the uae is a glaring reminder that revenue collection alone doesn’t guarantee development—how that money is used, monitored, and managed matters far more. In India’s case, the current state of roads reflects not a lack of funds, but a lack of political will to root out corruption, enforce accountability, and prioritize the public good over private gain.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel