1. The Meteoric Rise Nobody Questions

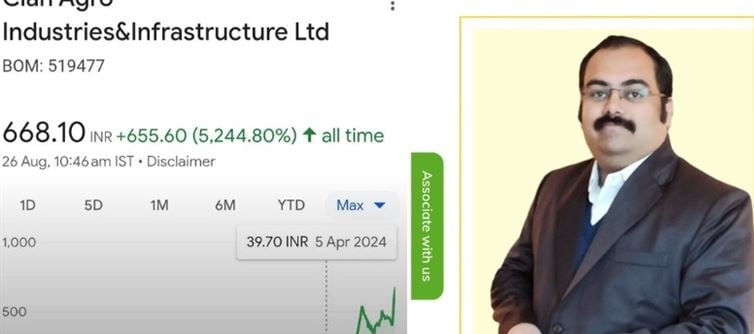

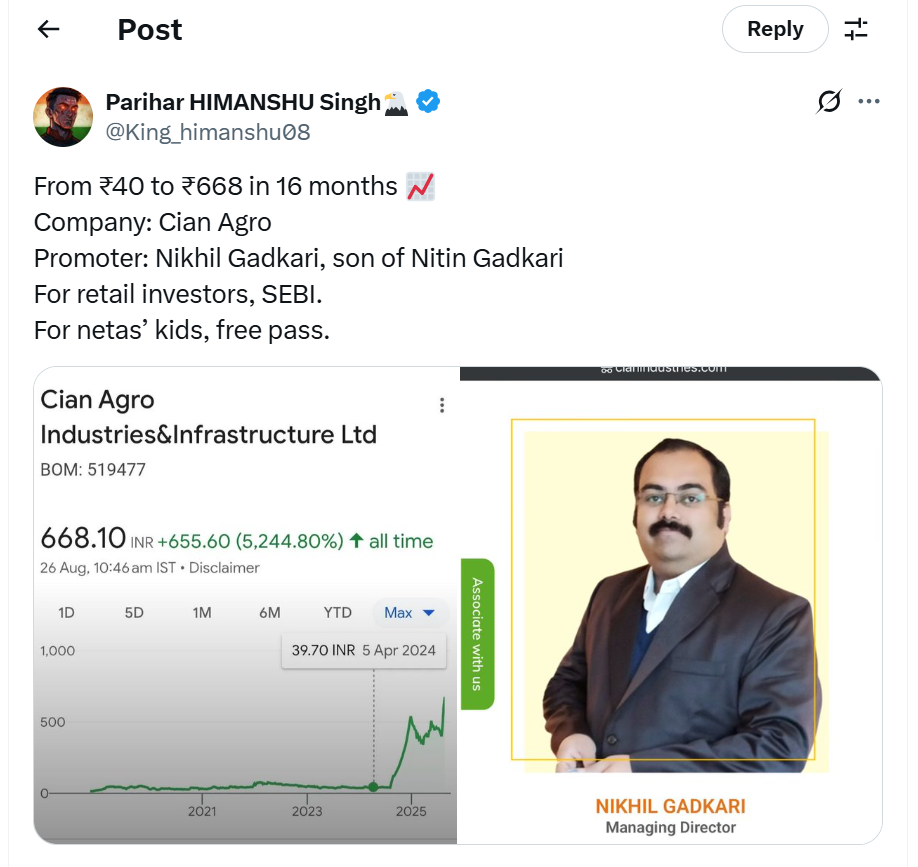

Cian Agro industries — a company linked to Nikhil Gadkari, son of Union minister Nitin Gadkari — saw its stock jump from ₹40 to ₹668 in just 16 months, a staggering 1,570% gain. For perspective, the benchmark Nifty 50 returned just ~20% in the same period. Retail investors in penny stocks with even half that jump usually face SEBI heat, trading suspensions, or forensic audits. Here? Silence.

2. SEBI’s iron Fist for Small Fish, Velvet Gloves for Big Names

• Retail case: Hundreds of small-cap scrips have been suspended after sudden 200–300% rallies. SEBI cites “unusual price movement” and “lack of fundamentals.”

• Political case: A 16x surge with scant public data, patchy disclosures, and unclear ethanol capacity expansion… yet not even a whisper of regulatory scrutiny.

It’s not a free market — it’s a feudal market.

3. Ethanol Expansion or Political Leverage?

Cian Agro signed a 2024 MoU for CO₂-based ethanol production. India’s ethanol ecosystem already has 500 distilleries with 18 billion liters of annual capacity. In such a crowded field, one small-cap firm with limited capacity disclosure doesn’t automatically justify a vertical price takeoff. What justifies it? The promoter’s last name, apparently.

4. Transparency for Some, Darkness for Others

Retail investors are bombarded with SEBI circulars:

• Quarterly earnings

• corporate governance disclosures

• Beneficial ownership filings

But in politically linked companies, opacity prevails. Investors can’t trace concrete numbers — no exact ethanol plant capacities, no forward earnings guidance. Still, valuations skyrocket. Compare this with companies like Shree Renuka Sugars or Balrampur Chini, where every ethanol expansion detail is public.

5. The Unequal Market: Two Indias in One Stock Exchange

• For common investors: Miss a compliance filing? Pay penalties. Trade a suspicious penny stock? Expect a trading ban.

• For political heirs: Build fortunes through unexplained rallies, expand into sectors cushioned by government subsidies (ethanol blending program), and enjoy zero pushback.

The result? Retailers lose faith, netas’ kids gain wealth, and the system looks designed to protect the powerful.

👉 Bottomline: When retail investors gamble, SEBI cracks the whip. When political heirs gamble, the market rolls out a red carpet. One india gets rules. The other gets the privilege. And the sufferers, yet again, are the ordinary people.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel