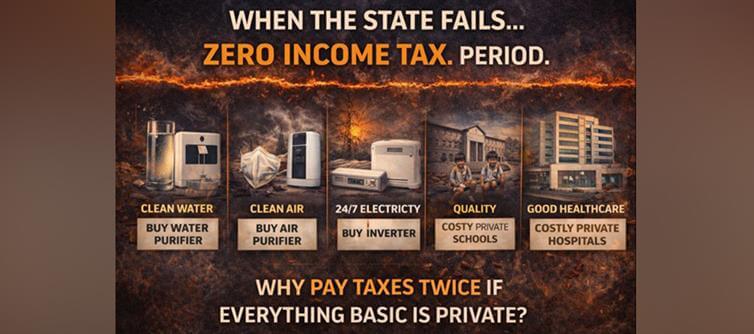

Clean water? Buy a purifier.

Clean air? Buy an air purifier.

24/7 electricity? Buy an inverter.

Quality education? Private schools.

Good healthcare? Private hospitals.

At some point, the question stops being rhetorical and becomes unavoidable: what exactly are we paying income tax for? When every basic necessity has to be purchased privately—after already paying taxes—the system isn’t welfare-driven. It’s extraction-driven. Citizens aren’t being served; they’re being charged repeatedly for the same promise.

1. Taxation Without service Is Just a Bill—Not a Social Contract.

Taxes are meant to fund essentials. When essentials still require private spending, taxation loses moral legitimacy. You’re not contributing to a system—you’re compensating for its failure.

2. Water and Air: The Bare Minimum, Now a Luxury.

Clean water and breathable air aren’t premium services; they’re foundational. When families must install purifiers and monitor AQI apps just to live safely, it’s proof that public infrastructure has collapsed where it mattered most.

3. Power Cuts Turn “24/7 Electricity” Into a Marketing Joke.

Inverters, batteries, and generators—none of these should be household staples in a functional state. Yet they are. Power reliability is outsourced to the individual, while the state collects taxes like it delivers excellence.

4. Education: Free in Theory, Expensive in Reality.

Government schools struggle with quality, accountability, and outcomes. parents who can afford it flee to private schools. parents who can’t are trapped. education becomes less about merit and more about money—despite being publicly funded.

5. Healthcare: Public in Name, Private in Practice.

Serious illness sends families straight to private hospitals, often at catastrophic cost. Public hospitals are overcrowded, understaffed, and underfunded. The taxpayer still pays—just now with loans, savings, and lifelong debt.

6. Where Does the Tax Money Go?

A significant chunk is burned on politically convenient freebies, optics-heavy schemes, and short-term appeasement instead of long-term fixes. Infrastructure doesn’t win elections fast enough. Handouts do.

7. Citizens Are Paying Twice—and Getting Half.

First, income tax. Then GST. Then, private spending on essentialsthat the state failed to provide. This isn’t a welfare model—it’s a double-payment trap.

8. If Everything Is Private, Then Taxation Needs Justification.

You can’t run a private-services reality with a public-taxation burden. Either deliver basics—or stop charging for them. There is no moral middle ground.

Final Word

A government’s first duty is not freebies, slogans, or schemes—it’s water, air, power, education, and healthcare. When citizens must buy all five privately, income tax stops being a contribution and starts looking like a penalty for earning.

If the state can’t guarantee the basics, then taxing income is indefensible.

Because a system that charges you for everything—after charging you tax—isn’t governance.

It’s billing.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel