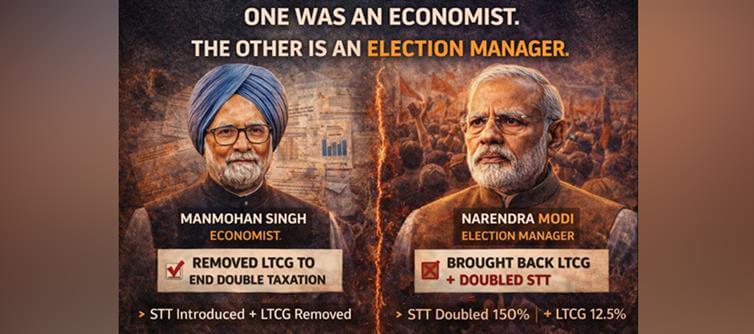

As outrage builds over the latest STT hike, it’s worth remembering a crucial piece of history that’s conveniently missing from the noise. STT was introduced, and LTCG was removed under Manmohan Singh for one clear reason: he opposed double taxation.

Fast-forward to today, and the philosophy has flipped on its head. Under Narendra Modi, not only is LTCG back at 12.5%, but STT keeps rising—this time by a staggering 150%. This isn’t a technical adjustment. It’s a worldview shift.

1. STT Was Meant to Replace LTCG—Not Sit on Top of It.

When STT was introduced, it came with a trade-off: remove long-term capital gains tax on equities. The logic was clean—avoid taxing the same economic activity twice. Markets got certainty. Investors got clarity. The state got predictable revenue.

2. That Principle Is Now Dead.

Today, investors pay both LTCG and a rising STT. That’s not reform. That’s a reversal. The original economic logic has been abandoned without debate, explanation, or justification.

3. Economist vs Politician Isn’t an Insult—It’s a Diagnosis.

Manmohan Singh approached markets as an economist: incentives matter, confidence matters, and capital is mobile. Modi approaches markets as a politician: who pays, who benefits, and who votes.

4. Traders Are the Safest Group to Tax—Politically.

Let’s be blunt. Most stock traders and market participants are not swing voters. Many openly support the current government. Doubling STT won’t cost votes. Silence is guaranteed.

5. Redistribute the Pain, Harvest the Votes.

The extra tax collected from a small, concentrated group can be redirected—directly or indirectly—towards welfare schemes for a much larger voting base. From an electoral lens, it’s a perfect trade.

6. Markets Don’t Matter at the Ballot Box.

Liquidity, efficiency, hedging costs—none of these win elections. Freebies do. Visibility does. Immediate gratification does. Market participants are expected to absorb the hit quietly.

7. This Isn’t About Curbing Speculation—It’s About Arithmetic.

If the goal were market stability, policy would be nuanced. Instead, blunt instruments are used because the political cost is near zero and the fiscal upside is immediate.

8. Policy Is Being Made for Votes, Not Value Creation.

Capital markets thrive on predictability. Constant tax tinkering sends the opposite signal. But when governance is guided by electoral math rather than economic reasoning, predictability becomes expendable.

Final Word

This isn’t nostalgia—it’s clarity about the present. One leader tried to remove double taxation to build confidence. The other has reintroduced it and raised it repeatedly, knowing full well that the affected group won’t push back at the ballot box.

That’s the difference between economic policy and political policy.

Between managing an economy and managing an election.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel