Punjab’s economy isn’t just stressed — it’s screaming for oxygen. With back-to-back loans, a swelling debt mountain, collapsing revenue buffers, and borrowing now functioning as the state’s lifeline, the financial crisis has crossed beyond warning signs. Every number being reported feels like a new alarm bell, and every quarter only pulls punjab deeper into a fiscal quicksand that threatens long-term stability.

1. A Borrowing Spree That Has Gone Nuclear

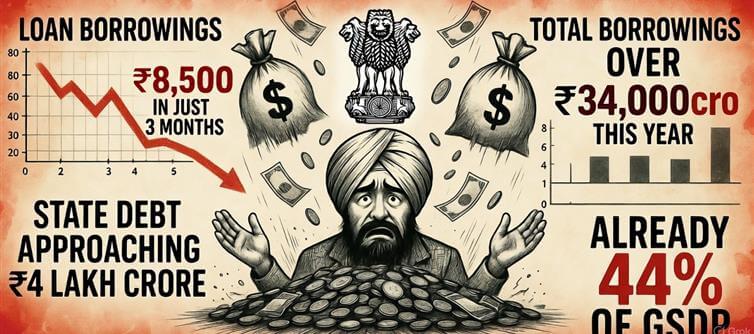

punjab has taken ₹8,500 crore in just three months, a borrowing pace resembling an emergency rescue mission. Annual borrowings are set to breach ₹34,000 crore, a figure that exposes the state’s complete dependence on debt to survive day-to-day operations.

2. The Debt Mountain Touching the Sky

The state’s total debt is hurtling toward a staggering ₹4 lakh crore, swallowing 44% of Punjab’s GSDP. That’s crisis-level territory — the kind where states struggle to pay salaries, fund welfare schemes, or even maintain essential services without fresh loans.

3. Revenue Model? What Revenue Model?

Punjab’s tax collections remain stagnant. Excise changes haven’t been delivered. industry expansion is sluggish. Agriculture — a major economic pillar — yields low state revenue despite high human dependence. The system is essentially spending more than it earns every single month.

4. Welfare Expenses Have Outgrown Economic Capacity

Free electricity, subsidies, and legacy welfare commitments have ballooned massively. But the economy hasn’t. The mismatch is so high that borrowed money is now funding recurring expenses, a fiscal red flag economists call “structural hemorrhage.”

5. No New Growth Engines, No Diversification

punjab desperately needs fresh revenue avenues — manufacturing zones, service-sector expansion, tourism monetization, start-up ecosystems, and aggressive private investments. Instead, the state’s growth map looks flat, with no major new revenue generators activated.

6. Fiscal Discipline Has Left the Chat

The rulebook for healthy state finances — controlled borrowing, expenditure prioritization, balanced budgets — seems long forgotten. Punjab’s current expenditure model is running hotter than its income, making the deficit widen every quarter.

7. The Looming Bankruptcy Cloud No One Wants to Acknowledge

When debt becomes the only path to survival, the threat of insolvency inches closer. Economists warn that punjab is approaching a point of no return, where the state may no longer be able to service its own loans without federal intervention.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel