Streamlined system of ITR filing??

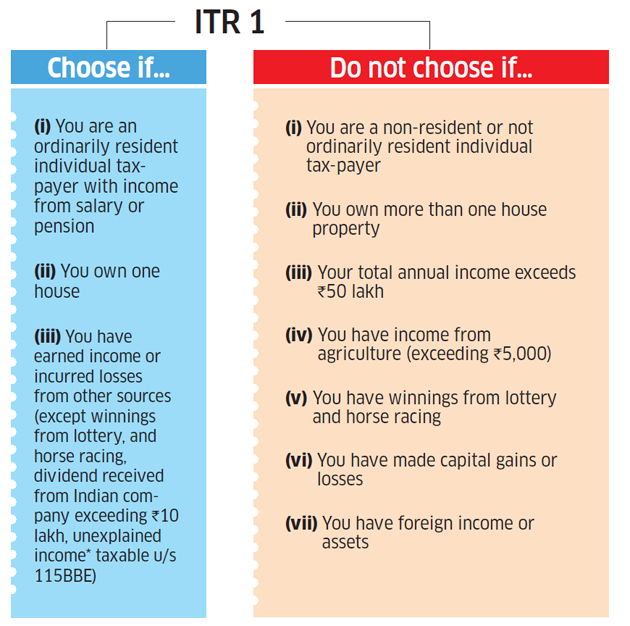

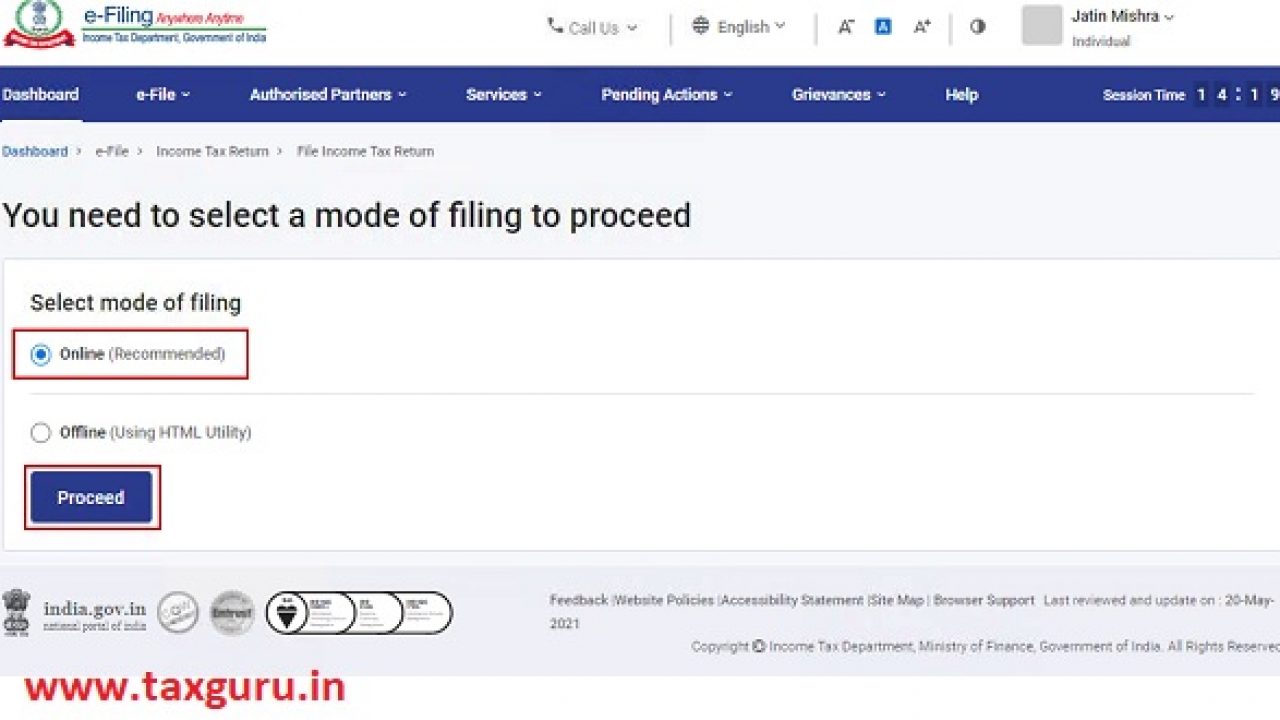

From next year it will be easier for taxpayers to pay taxes. In fact, for the past few years, the government has been working vigorously to simplify ITR filing. In such a situation, the exercise of collecting the data of taxpayers was going on. Now the government has deposited a lot of information in this matter, due to which only some minor information will have to be filled in the income tax form from next year. The Income Tax Department must have already filled many information including bank interest.

With these facilities, half the work of filing one way ITR will now be done by the Income Tax Department itself. Along with this, a big preparation has also started to bring more and more people under the tax net. TDS will be made the basis for this. Those people whose income is being TDS but they are not filing income tax return, then double TDS will be charged from such people.

Along with this, the Income Tax Department has also simplified the system of income tax filing and the way to rectify the errors in it. Experts also believe that the option of filing updated returns is beneficial for the people as the current period for rectifying the mistake is very less. Obviously, with the advent of this facility, the number of tax payers will also increase and people will contribute to the government's treasury by filling the returns of their previous years.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel