After lowering, SBI's revised RBLR will be 8.15% as opposed to its previous rate of 8.65%. sbi has also updated home loan rates and fixed deposit rates, or FD rates, in addition to EBLR.

EBLR: What is it?

Banks set their interest rates on loans, including retail and MSME loans, using the External Benchmark Lending Rate (EBLR) system. The RBI repo rate and other external benchmarks are directly correlated with EBLR lending rates. Home loan rate decisions become more flexible and transparent in response to environmental changes when EBLR loan rates are linked to external standards.

Home Loan Rates and sbi EBLR

According to SBI's website, the company's home loan rates will fall between 7.5% and 8.45% following the EBLR amendment. Home loan rates are also influenced by a number of other factors, such as the borrowers' credit history and credit score, or CIBIL score.

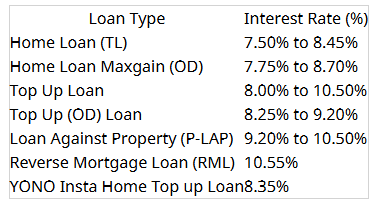

According to SBI's official website, interest rates for the home Loan (TL) category can range from 7.5% to 8.45%. Furthermore, interest rates for the home Loan Maxgain category will range from 7.75% to 8.7%, while those for Top Up Loans will range from 8.25% to 9.2%. Likewise, interest rates for the yono Insta Top Up Loan category can reach 8.35%.

According to SBI's official website, interest rates for the home Loan (TL) category can range from 7.5% to 8.45%. Furthermore, interest rates for the home Loan Maxgain category will range from 7.75% to 8.7%, while those for Top Up Loans will range from 8.25% to 9.2%. Likewise, interest rates for the yono Insta Top Up Loan category can reach 8.35%.Lower EBLR and house loan rates will facilitate bank lending and make loans more affordable for borrowers. Easy access to financing will increase consumption and economic activity.

SBI Revises Special FD Scheme Rates

SBI has altered its FD rates for specific schemes in addition to lowering home loan rates. The website states that, as of june 15, 2025, sbi has reduced interest rates on its special deposit plan, "Amrit Vrishti" (444 days), by 25 basis points.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel