Pushpa Telugu Movie Review, Rating

పుష్ప తెలుగు సినిమా రివ్యూ ,రేటింగ్

-

Pakistan Airspace Ban..!? Air India faces a loss..!?

-

The challenges ahead of Hrithik's War 2..!?

-

Surya's Retro's 3-day collection..!!?

-

Who is giving Pakistan so much money?

-

Pakistan is running out of ammunition..!?

-

Shubman Gill and Sara Tendulkar had broken up..!?

-

Red Hot Rakul Preet Flaunts Her Tempting Assets In Bralette and Skirt

-

Samantha Opens Up About Perimenopause

-

Why did Virat Kohli not celebrate the victory against CSK..!?

-

Rashmika Mandanna Selfie Dump Leaves Fans Drooling

-

Visibly Upset Pooja Hegde Smiles And Covers Her Sorrowness

-

Anil Chaudhary explains why Brevis was denied review..!?

-

Pooja Hegde Rough Patch Continues...

-

Tamil Nadu CM Warns Educational Institutions Spreading Superstitions

-

Natural remedies to lighten dark elbows and knees

-

What's HOT BEDDING? How Canada Woman Earned $50,000 With This Arrangement?

-

UP - 16-Year-Old Dalit Girl Attacked and Dragged For Resisting Molestation In A Bus

-

Rapido Driver Manzhar Caught Red Handed While Planning To Rape A Woman Who Booked His Ride

-

Pune - Shaikh Urinates On Idol Of Goddess Annapurna and claimed 'Hindus Can't Do Anything'

-

Former Pakistan PM Imran Khan Raped In Jail? 'Medical Report' Sparks Outrage

-

Baba Vanga's Shocking Deadly Prediction For July 2025 - If It Comes True...

-

Srijani Mukherjee - 17 Year Old ISC Topper Removes Surname And Adopted 'Humanity' As Her Religion

-

What Happens When You Drink Garlic Juice On Empty Stomach Every Morning?

-

How Farhan Who Made Rape Porn Of Hindu Girls Was Encountered? True Story

-

Bollywood Hero Lost Control While Acting In A Kissing Scene - Heroine Was Rescued by Director

-

India or Pakistan - Muslim countries like Saudi Arabia, Qatar, UAE, Turkey announce support for...

-

Indian Satellites Practising "Dogfights" In Space - Do You Know What It Means?

-

Bankrupt Pakistan Faces Shortage Of Artillery Ammunition - Can Sustain War Just For 4 Days

-

Do you know the straight lines on your towel have a meaning? These stripes are called...

-

Bihar - Mohd Sahil Trapped Hindu Girls, Made Vulgar Videos and Sold Them On Porn Sites

-

What is the Full Form of AM and PM? What Does it Actually Mean?

-

Rashmika Mandanna Onboarded As Brand Ambassador For Crocs India

-

Pakistan Opens Border Gates - Finally Takes Back Its Citizens From India

-

"Rape as many Hindu girls as possible, It's a Virtuous act" - Gang Leader Farhan Says No Regrets

-

When Samantha Preferred Capes Over Jumpsuits

-

You Must Completely Avoid These Three Daily Foods To Protect Your Liver - Not Alcohol

-

19-Year-Old Delhi Boy Gaming Addiction Lead To Partial Paralysis & Bent Spine

-

Pooja Hegde Shocked By Theater Occupancy & Box-Office

-

Supreme Court Says "Employee Doesn't Have Right To Promotion, But They Had The Right To Be..."

-

Sleeping With AC Turned On Whole Night? You Are Spoiling Your Health Badly!

-

Pooja Hegde Reveals Playing 'THIS' Character Was The Most Fun Thing

-

Babar Azam Insta Story Shocks Pakistan - Lashes Pak Army and says India is my Second Home

-

Kanpur - Parents Catch Son and Girl Friend Together, Thrashes Them In Public

-

Pooja Hegde Flop Streak Has A Connection With MS Dhoni

-

ISKCON Temple Looks Like Mosque Construction In Progress - Invites Controversy

-

Constable Marries Pakistani Girl - CRPF To Take Strict Action For Not Asking Permission

-

Is Erectile Dysfunction early warning of heart disease? Will Viagra Help?

-

BIG worry for India as Hamas strikes big deal with... Plan More Attacks...

-

Yogi Babu's fans are strongly criticizing this statement on social media??

-

'Shahrukh's character in Darr could have even raped??

-

Why are Salman Khan's films flopping?

-

Tension increased between India and Pakistan!!

-

What did Ramdas Athawale say about the film Phule Row?

-

What did Bhumi say to Ishaan that the actor confessed his fault?

-

Anil Kapoor's emotional moment with his special friend!

-

People's favorite show Panchayat is returning with its new season!!

-

An old video Kriti Sanon's mother is going viral on social media?!!

-

Mira Rajput unable to talk to friends after marriage to Shahid Kapoor?

-

Telugu cinema producer Abhishek Agarwal has announced this in Waves 2025

-

Nirmal Kapoor had written to grandson Arjun Kapoor and expressed her heart's desire!!

-

The singer says that the music industry will get a boost through this summit??

-

OTT platform Ullu app has removed its reality show 'House Arrest'

-

Ajay Devgan worked with actresses younger than him??!

-

Pakistan takes away the hosting of this tournament!!

-

Mehbooba Mufti used to visit the homes of terrorists?

-

Jammu and Kashmir CM came to Delhi amid tension over Pahalgam?!

-

What did PM Modi write in the congratulatory message to Anthony Albanese?

-

Haryana gets water,... then we will not tolerate it?

-

'Punjab takes final decision', said CM Mann on water dispute!

-

Rahul Gandhi's hard work paid off.., Devendra Yadav said on caste census!

-

Chargesheet against former AAP MLA Naresh Balyan!

-

Pravesh Verma's statement, This step will benefit every section...!

-

Did Allu Arjun ignore his fan..!?

-

"Ghost Towns": How Pakistanis preparing for a long war..!?

-

Pakistan is set to test a fire ballistic missiles..!?

-

Nani breaks records after Mahesh Babu..!?

-

We are lagging behind America in theaters: Aamir Khan..!?

-

Star Hero loses his mother...Nirmal Kapoor passed away...

-

SRH's big spend this year..!? Poor results..!?

-

Does BJP want to divert attention from Pahalgam attack?

-

Congress leader Udit Raj's big statement on caste census!

-

Devendra Yadav's big claim on ACB's action in classroom scam...

-

What is AAP's stand on caste census? Sanjay Singh’s statement!

-

What did AAP say when ACB filed case against Manish and Satyendra?

-

Manish Sisodia and Satyendra Jain's troubles increased!

-

Heat stroke patients will be treated with cooling technology!

-

JDU busy taking credit by putting up posters!

-

Former BJP MLA beats a young man with slippers...

-

BJP's uneasiness increased due to the claim of CM of this state!

-

Caste Census: Pappu Yadav calls it a victory of 'ancestors'!

-

Waving a country-made pistol at a wedding ceremony

-

IPL star Vaibhav Suryavanshi's uncle congratulates him!

-

Jitan Ram Manjhi silenced the opposition on caste census?

-

RJD calls caste census as Tejashwi's agenda!

-

Pankaja Munde's statement on the decision of caste census...

-

Supriya Sule's big statement on caste census!

-

The accused gave a shock to police-escaped in a filmy style!

-

What are Muslim leaders saying on caste census?

-

Ajit Pawar's big statement on Pahalgam attack...

-

Waris Pathan said a big thing on Vinay Narwal's wife

-

Raj Thackeray kept silence on Uddhav Thackeray...

-

BJP MP got angry when Ajit Pawar inaugurated the building!

-

Woman created a ruckus in RTO office, slapped employee

-

After the decision of caste census, Bawankule's big statement!

-

Sanjay Raut's big statement on Rahul Gandhi...

-

Eknath Shinde's big statement on the decision of caste census...

-

Shikhar Dhawan is openly in love, Photo with 'mystery girl'!

-

Sai Sudarshan snatched Orange Cap from Yadav!

-

Indian government banned Instagram accounts of Pakistani cricketers!

-

MI registered the third biggest win, record of 'clean sweep'!

-

You will no longer be able to order food from Zomato?

-

Will iPhone also become expensive after tariff hike?

-

Jyotika’s Inspiring Weight Loss Journey!

-

Can Wellness Teas Help With Weight Loss and Belly Fat?

-

Benefits of Doing Surya Namaskar Every Day!

-

Is Sleeping In AC All Night Bad For Health?

-

Simple Post-Dinner Habits Will Boost Your Weight Loss!

-

Will the CSK - RCB match take place?

-

Online game addiction that damaged the spine...!?

-

Pushing Too Hard at Gym Could Lead to Cardiac Arrest?

-

Eat This Fruit On An Empty Stomach To Keep Your Liver Healthy!

-

Pahalgam incident: Asia Cup cricket series may be canceled..!?

-

Best liquor in 2025..!! India's Jin Jiji is recognized worldwide..!

-

How Obesity is Fueling Chronic Diseases?

-

Is Your Heart at Risk During a Heatwave?

-

Goodbye To Unwanted Headaches With Natural Home Remedies!

-

Surprising Foods That Balance Hormones Naturally!

-

Hyderabad faces a water shortage..!? Apartment owners suffer..!?

-

Are you Trying To Lose Weight? Do These Things!

-

What are the Signs Your Hair Fall Is Not Normal?

-

You cannot sneeze with your eyes open. Try it!

-

How Parrots and rabbits can look behind without turning their heads?

-

Vijay's Jana Nayagan shooting halted due to rain..!?

-

Pat Cummins breaks Kavya Maran's game plan..!?

-

Virat Kohli clarifies Instagram likes on actress Avneet Kaur..!?

-

Why Do Objects Float Or Sink?

-

How does the Lotus Flower Clean itself?

-

When will uncle and nephew come together in Maharashtra politics?

-

Shubman Gill directly clashed with the umpires..!?

-

BJP MLA's demand on Ejaz Khan's show - 'Obscenity in house arrest...'

-

Will there be any action against Ejaz Khan?

-

Pankaja Munde harassed by obscene calls and messages?

-

SRH cheated of 6 crores, what did Nitish Kumar Reddy's father do?

-

'Will grab 7 states of India', BCCI can take 'strict' action!

-

Shikhar Dhawan shares a special picture with girlfriend!

-

Is this player's 'promotion' confirmed after IPL 2025?

-

No entry for 'men' in women's cricket, SC gave wonderful decision!

-

How much is the property of Suryakumar Yadav?

-

Former cricketer Shahid Afridi's provocative statements

-

Caste Census - Why Modi Govt Took An U-Turn?

-

Varanasi - Muslim Guy Thrashed for Touching Girl Inappropriately At Ganga Aarti

-

This caste has largest population in India - Not Dalits or Brahmins

-

Bhopal - Woman Raped By Husband's Elder Brother 3 Days After Marriage

-

Going To Post Memes? You Might Be Landing In Jail - HB 366 bill Passed

-

9 Harmful Cooking Oils You Must Avoid In Kitchen

-

Rakul Preet Husband Says "Nobody Understood Our Pain"

-

USA Vice President Urges India Not To Trigger War With Pakistan

-

If India fires a nuclear missile on Pakistan., how much area will be destroyed?

-

Rakul Preet Singh Views On Séxuality - Fans Shocked With Her Answer

-

China Claims Covid-19 Originated In US - "Don't Act Dumb"

-

Nainital - Police Slaps Female Tourist, Sparks Public Outrage

-

Time For Samantha To Show Her Marketing Strategy

-

India Sends Back - Pakistan Refuses to Take Back Its Citizens

-

Don't Target Muslims or Kashmiris - Wife of Navy Officer Killed In Pahalgam Attack

-

Fans Unhappy To See ZERO Glamour From Pooja Hegde

-

Don't Target Muslims or Kashmiris - Wife of Navy Officer Killed In Pahalgam Attack

-

Islam to rule the world by 2060 - Muslim Population Will Rise By...

-

Pooja Hegde Upset as 'RETRO' Fails at Box-Office

-

Female Vibrators In Digha - Mamata Banerjee's Government Makes An Embarrassing Mistake

Empowering 140+ Indians within and abroad with entertainment, infotainment, credible, independent, issue based journalism oriented latest updates on politics, movies.

India Herald Group of Publishers P LIMITED is MediaTech division of prestigious Kotii Group of Technological Ventures R&D P LIMITED, Which is core purposed to be empowering 760+ crore people across 230+ countries of this wonderful world.

India Herald Group of Publishers P LIMITED is New Generation Online Media Group, which brings wealthy knowledge of information from PRINT media and Candid yet Fluid presentation from electronic media together into digital media space for our users.

With the help of dedicated journalists team of about 450+ years experience; India Herald Group of Publishers Private LIMITED is the first and only true digital online publishing media groups to have such a dedicated team. Dream of empowering over 1300 million Indians across the world to stay connected with their mother land [from Web, Phone, Tablet and other Smart devices] multiplies India Herald Group of Publishers Private LIMITED team energy to bring the best into all our media initiatives such as https://www.indiaherald.com

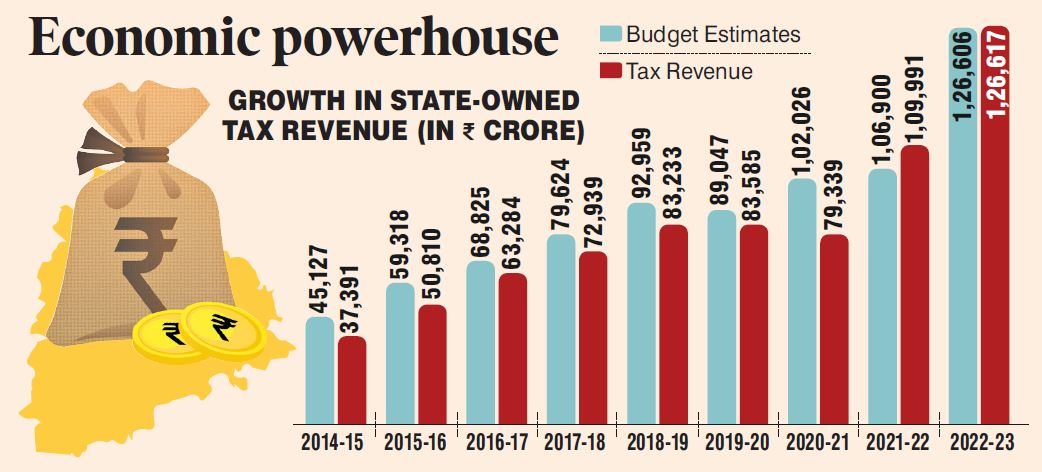

The entire income receipts of telangana were Rs 1.92,097 crore, showing a shortfall of Rs 53,159 crore as against budget forecasts of Rs 2,45,256 crore in 2022–23. This was made possible by the BJP-led central government's apartheid towards telangana, which turns out to be a severe loss.

The entire income receipts of telangana were Rs 1.92,097 crore, showing a shortfall of Rs 53,159 crore as against budget forecasts of Rs 2,45,256 crore in 2022–23. This was made possible by the BJP-led central government's apartheid towards telangana, which turns out to be a severe loss.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel